How To Rock Your Freelance Finances In 30 Days

Feast or famine. The up and down income roller coaster. It gets old, doesn’t it? Wouldn’t it be great if your income and expenses were more consistent? If you’re a freelancer who’s tired of having too much month at the end of the money, here’s how to up your finance game and learn a proven system that will help you keep track of your cash flow.

Feast or famine. The up and down income roller coaster. It gets old, doesn’t it? Wouldn’t it be great if your income and expenses were more consistent? If you’re a freelancer who’s tired of having too much month at the end of the money, here’s how to up your finance game and learn a proven system that will help you keep track of your cash flow.

The Freelance Finance Fortress

You need to take your finances seriously if you’re going to stay cubicle-free over the long haul. I’ve been freelancing for 20 of the last 30 years, and during that time I’ve had some tremendous financial disasters along with some huge wins.

But I will always be thankful for my 10 years in the corporate and agency world, because it was there that I finally learned how to run a business. To protect your finances, you need to setup a fortress. A “Freelance Finance Fortress”, or “F3” for short.

The F3 is an online system to plan and track your freelance finances. Once it’s up and running, you’ll be able to run your business from anywhere with an internet connection. I use it daily to manage my business directly from my iPhone. It helps me sleep much better at night and is especially helpful for tax preparation.

Setting Up Your Freelance Finance Fortress

Setting up your F3 consists of integrating multiple online accounts into a system that lets you manage the entire business in one place. It may seem daunting at first, but once everything is setup it’s easy-peasy.

You’ll need to have the following items established before you can setup your F3:

- EIN Number

- Business License

- Business Checking Account

- Business Credit Card

- Online Payments Processor

- Online Savings Accounts

- Online Invoicing System

- Online Bookkeeping System

EIN Number

In the US, an EIN Number, or Employer Identification Number, establishes your business as a separate entity with the IRS. While you can open a sole proprietorship with your social security number, you run the risk of identity theft. An EIN Number also makes it easier to completely separate your business and personal finances.

Business License

Before you can open a business checking account, most municipalities require you to obtain a local business license. You will need this and your EIN number to open the account. The good news is that this is a pretty simple process.

Visit your city or town clerk’s office and apply for a sole proprietor business license. Once you have been blessed by city hall and have your EIN, head on over to your local bank and open a business checking account.

I recommend using a local bank over an online bank. You never know when you may need a business loan, and loans are usually easier to get if your banker knows you personally. Just make sure they have online banking services and you should be all set.

Business Credit Card

If you can, get a single business credit card and use it for all of your business expenses. A single business credit card will allow you to streamline all of your purchases and track them more efficiently. You can also use a personal credit card just dedicated to business expenses, but be careful. Do not run up debt on this card – only pay for purchases if you have the cash on hand.

Online Payments Processor

An online payments processor lets you easily accept and make payments online. While there are many such services, the easiest and most widely used is Paypal. You want to become a verified business owner in your Paypal account.

Online Savings Accounts

Yep, you read that right – I said accounts, not a single account. The cornerstone of your Freelance Finance Fortress is your savings program, which should be based on a minimum of three separate online accounts:

- Emergency Savings

- Tax Fund

- Retirement Savings

“But how can I save anything if I’m broke”, you ask? Just start. And start simply. For example, the next time you get paid, set aside a certain percentage to each of these accounts. Start small, say with just 3%. So if you get $100, put $1 in your emergency fund, $1 in your tax fund, and $1 in your retirement fund.

I know it’s only $3, but if you’ve got no savings, $3 is a start and way better than nothing. And trust me, it will grow over time. Capital One 360 has a great online savings program.

And remember – if you still worked for the man, your employer would lop off about 30% of your paycheck before you ever saw a dime. You need to do the same for yourself, so plan to eventually increase these amounts until you’re able to set aside (gulp!) at least 30% of everything you bring in.

Online Invoicing System

I used to prepare invoices as PDFs with my company logo on them, but it took way too much time. It was also hard to track how long it took to collect if clients were late in paying me. That all changed when I switched to an online invoicing system.

There are a lot of solutions out there, but my favorite is still Freshbooks. It’s so easy to use and easily integrates with other programs like Go Daddy Bookkeeping (see below).

Online Bookkeeping System

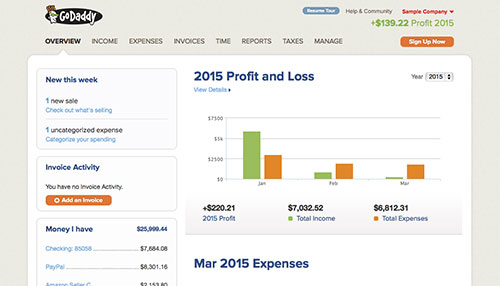

Last but not least, the F3 depends on an online bookkeeping system that acts as your Freelance Finance Dashboard. This is where you pull everything together so you can see what goes where, and how much you’re left with at the end of the day. This is why all of your accounts need to be online. Here’s how it works:

- I use Go Daddy Bookkeeping, which costs $10 per month.

- My Freshbooks invoices feed directly into Go Daddy Bookkeeping.

- Most of my expenses run through a single business credit card. I classify them within Go Daddy Bookkeeping according to Schedule C deductions.

- Everything else runs through Paypal and is classified the same way.

- Whenever I receive payment or make a payment the bookkeeping system is automatically updated. No more looking for receipts and compiling big long spreadsheets. It’s magic. And preparing my taxes is a snap.

This makes it super-easy to run profit and loss reports on a weekly, monthly, quarterly or annual basis. By keeping a close eye on what’s coming in and what’s going out, I’m able to adjust my spending and savings as needed.

For example, if I’m having a slow month, I’ll move some of my emergency savings over to my checking account to tide me over until I can pay it back. Likewise, every time I get paid I shove 30% over to my savings accounts so 1) I’ll have a cushion when I need it, 2) I’ll be able to pay my taxes when they’re due, and 3) I’ll be able to invest in my business and save for the future.

Your Turn

I can’t emphasize how important it is to get a handle on your finances. It is the only way to stay afloat and prosper as a freelancer. How about you? How do you juggle your finances? Do you have enough money at the end of the month? I’d love to see your thoughts in the comments.